Important tax changes to the small business deduction (SBD)

Published on

Several years ago, governments introduced the small business deduction (SBD) to foster SME development. Since then, the SBD has undergone a number of modifications, but due to proposed amendments at the federal and provincial levels, many changes are ahead in 2017.

This article provides a summary of the changes to the SBD that will take effect in 2017.

Federal

First, note that the previously announced SBD reduction, which was to occur from 2017 to 2019, has been rescinded. The federal small business tax rate will remain at 10.5% after 2016.

Second, for taxation years beginning after March 21, 2016, the ability to multiply access to the SBD will be denied in the following situations:

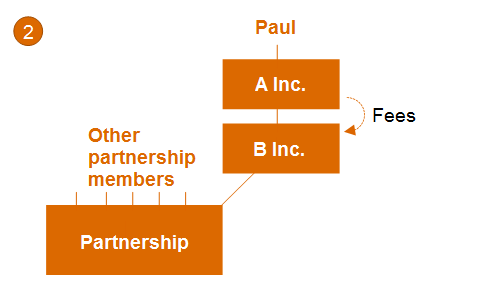

- when a member of a partnership does not deal at arm’s length with a corporation (or a shareholder of the corporation), the corporation is not a member of the partnership and the corporation earns fees from the partnership under a contract for services;

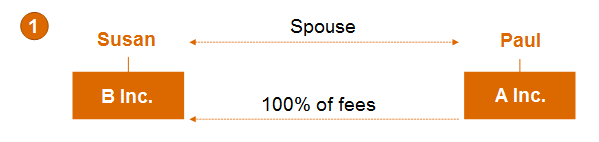

- when a corporation provides services or property to another private corporation and the corporation, one of its shareholders, or a person who does not deal at arm’s length with such a shareholder has a direct or indirect interest in the private corporation.

In these 2 cases, the income earned will not be eligible for the SBD, except if the partnership member (in the first case) or the other private corporation (in the second case) assigns a portion of its SBD limit to the corporation.

Let us consider how the new rules affect the following structures:

In both situations, the fees that Corporation B earns from Corporation A will fall under the new rules. That is why it will be important to assess eligibility for the SBD when fees come from partnerships or entities where shareholders do not deal at arm’s length with the corporation.

Provincial

For taxation years beginning after 2016, corporations must meet additional criteria to qualify for the SBD and the reduced rate of 8%. A corporation will meet the qualification criteria if during the taxation year its employees worked at least 5,500 hours, and if during the previous taxation year the number of hours worked by its employees and the employees of the corporations with which it is associated total at least 5,500 hours.

Several specific rules apply in calculating hours worked, including:

- a maximum of 40 hours per week per worker may be considered;

- the hours worked must be paid at the time the SBD is claimed;

- the hours worked for a corporation by one of its shareholders, without regard to whether they are compensated.

Conclusion

Practitioners who wish to claim the SBD for a corporation must ensure that it meets the new federal and provincial qualification criteria. Moreover, as discussed above, the federal and provincial rules do not apply to the same situations.

Partner, Tax Services

PwC