Modules content

Core modules

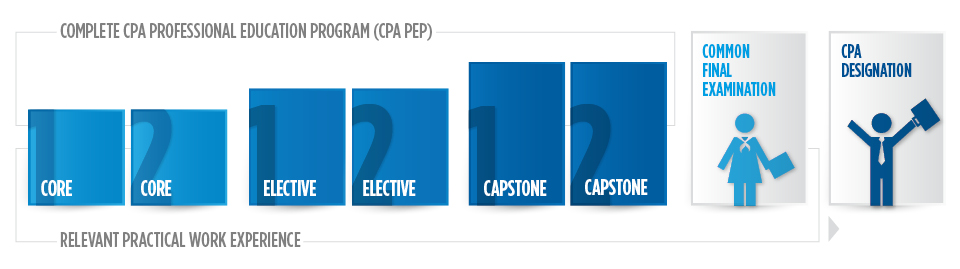

The Core 1 module primarily focuses on financial accounting and reporting and the Core 2 module focuses on management accounting, planning and controls.

In both modules, you will build the enabling and technical competencies required of a CPA. The modules are integrative, drawing on law, economics, finance, strategy, statistics and IT, as well as the technical competency areas. Candidates will develop competence in integration and in applying aspects of all areas of the CPA Competency Map: financial reporting, strategy and governance, management accounting, audit and assurance, finance, and taxation.

Elective modules

Out of the four available options, you will need to choose two elective modules. The elective modules will provide you with an opportunity to explore a field in greater depth.

Objective

Equip candidates with the ability to contribute to strategic decision making, support effective governance, manage and mitigate risk, and assess overall performance management.

Learnings

- Apply conceptual frameworks for strategy, governance, risk and performance in more complex settings than dealt with previously.

- Develop competencies used to focus an entity on improving performance and delivering sustainable value.

Objective

Equip candidates with the competencies necessary to develop overall finance policies and to identify, analyze, evaluate and recommend investment and financing decisions.

Learnings

- Apply the appropriate finance principles and conceptual approaches to determine appropriate courses of action.

- Develop the capability to provide finance-related services for an entity, either individually or as part of a larger team, to understand when the advice of a finance specialist is required, and to understand and communicate with other finance professionals.

Objective

Equip candidates with the competencies necessary to perform both internal audit projects and external assurance engagements, from assessing the need for an engagement or project, to developing and performing the procedures, through to documenting and reporting results.

Learnings

- Study the key concepts of auditing, such as risk, materiality and internal control, which are concepts that have broad application.

- Delve into some of the more complex financial accounting topics and understand how governance plays a key role in assurance.

* This module is mandatory to obtain the public accountancy permit.

Objective

Equip candidates with the competencies necessary to provide taxation services and guidance. The scope includes assisting individual and corporate entities to minimize taxes and meet their objectives while remaining in compliance with tax laws and regulations.

Learnings

- Address compliance and tax-planning issues for individuals and corporate entities, with some exposure to partnerships and trusts.

- Go beyond presenting the issues and consider the broader circumstances and risk tolerance of all stakeholders involved.

- Develop competence in the areas of tax governance, controls and risk management by exploring the relationship between financial reporting decisions and taxation, and considering the importance of taxes when making business and investment decisions.

* These modules are mandatory to obtain the public accountancy permit (CPA auditor).

Capstone modules

In the capstone modules, you will learn about team management and how to communicate in a professional environment, and deepen your strategic leadership competencies using the knowledge acquired in the prerequisites and earlier modules as you prepare for the Common Final Examination (CFE). Both modules focus on the application and integration of the competencies.

Important: It is highly recommended that candidates take the Capstone modules 1 and 2 immediately leading up to the CFE. For instance, if you are planning to write the CFE in September, you should register to the Capstone 1 starting in May and to the Capstone 2 starting in July. However, if you are planning to write the CFE in May, you should register to the Capstone 1 starting in January and to the Capstone 2 starting in April.

Objective

Integration of the core technical and enabling competencies.

Learnings

In this module, you will work in a team on a national immersive case and submit weekly assignments: team reflections, portions of the Board Report. In addition to preparing an extensive written report, you will present your recommendations before a board of directors or senior management team. You will develop your competencies in team management, leadership and communication.

This immersive case is linked to Day 1 of the CFE.

Objective

Preparation for the CFE.

Learnings

This module is designed to enhance the competencies acquired in preparation for the CFE through application and integration. During the module, you will receive a variety of feedback and support related to the CFE simulations, including:

- case-specific debrief guidance;

- technical knowledge support, particularly in the area of elective concentration;

- peer study and assessment opportunities;

- stress management strategies.