New professional program

Changes coming to the

CPA profession in 2027

A brand-new professional program is coming soon – modernized, bold, and rooted in today’s realities. Designed to train the CPAs of tomorrow, it is based on the latest learning methods and a deep understanding of the key competencies CPAs need in a world defined by sustainability and emerging technologies, including artificial intelligence.

What’s changing in the new CPA Professional Program:

- Revisited learning methods focused on action and analysis

- Modernized competencies: critical thinking, professional judgment, strong ethical sensibility

- Increased focus on contemporary issues: value creation, sustainability, ESG, artificial intelligence, data governance

- Progressive evaluation spread out across the learning process

- Case studies based on practical scenarios and real-world cases that reflect the current CPA practice

What remains at the core of the CPA program:

- Thorough, recognized training that prepares future CPAs for the challenges of the job market

- A recognized professional designation that’s highly sought after in the business world for national and international job mobility

- Diversified learning covering the many different areas of CPA practice

Key dates

The new program will be offered starting in 2027. For the program offered by the Order, registration will begin in January 2027. For the program offered by universities, some of them will only offer the new program starting in September 2027. It is therefore important to contact your university to plan your registration.

Discover the new

CPA Professional Program

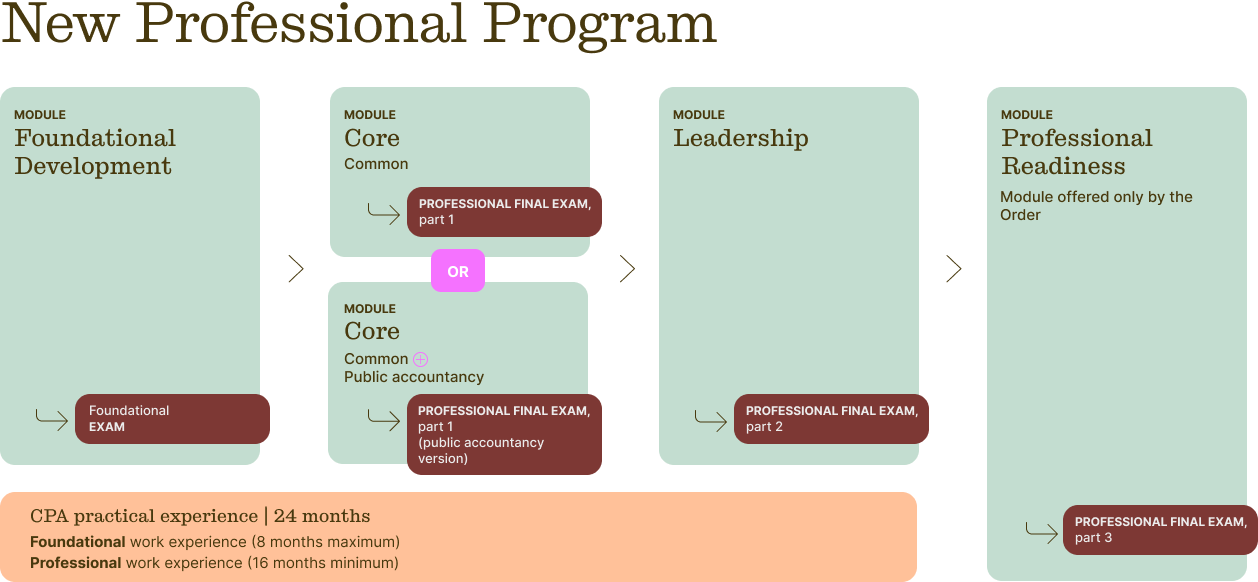

Future CPAs will work through the new CPA Professional Program one module at a time. They will need to finish each module in order and pass the associated exam before moving on to the next one.

If you do not hold one of the bachelor’s degrees recognized by the Ordre or the equivalent, you will need to go through the equivalence process before starting the CPA Professional Program. For full details, visit the website regarding the equivalence process.

Description of practical experience and modules

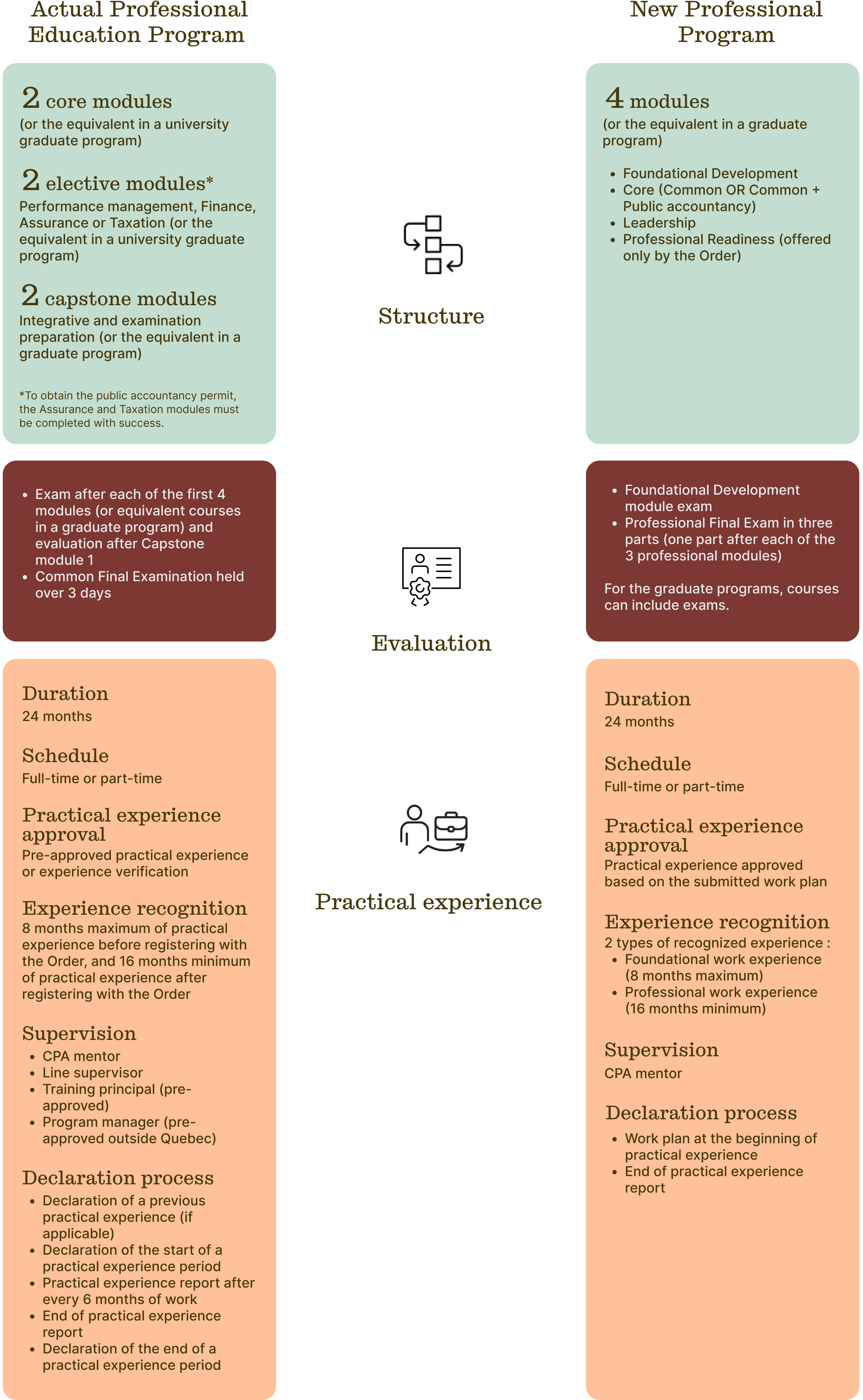

Practical experience

This the chance for candidates to apply what they’ve learned and develop their skills in a real professional setting. Practical experience gives the structure and support needed to progress gradually toward the level of proficiency expected from CPAs.

- Total duration: 24 months

- Designed to help progress logically through the technical and behavioural competencies

- Practical experience must be completed before starting the CPA Professional Readiness module

There are two types of practical experience:

- Foundational work experience (maximum of 8 months)

Foundational work experience lets candidates apply what they've learned in a supervised environment where they're exposed to different aspects of the practice. This type of work experience is not mandatory. For instance, the 24 months of recognized practical experience may consist entirely of professional work experience. Note, however, that any practical experience acquired before registering with the Quebec CPA Order can only be recognized as foundational work experience.

- Professional work experience (minimum of 16 months)

Professional work experience helps candidates consolidate their knowledge, develop autonomy, start taking on more strategic analyses, and acquire decision-making competencies. At least 16 months of professional work experience must be completed, but the 24 months of recognized work experience may consist entirely of professional work experience.

Foundational Development

In this first module, candidates will lay the groundwork for the rest of their CPA path. They'll acquire solid technical and professional competencies and start to develop the mindset that sets CPAs apart: rigour, ethics, and a sense of responsibility. They’ll also learn about the foundations of the CPA profession, gaining essential background to understand major issues in the business world. It’s a great opportunity to apply their knowledge to real-life situations and prepare themselves to make a real difference.

CPA Core

This module marks an important turning point where candidates will choose one of two paths based on their professional aspirations.

Common

This path is meant for candidates who want to acquire the CPA designation, but do not want to obtain a public accountancy permit. In this module, candidates will build their competencies in key areas such as:

- Financial accounting

- Big data and data analytics

- Taxation

They’ll also continue developing their CPA advanced professional competencies.

Common + Public accountancy

This path is meant for candidates who want to obtain a public accountancy permit (CPA auditor designation). It includes all the same content as the Common path, while diving deeper into the following areas:

- Financial accounting

- Assurance and trust

- Big data and data analytics

- Financial reporting

- Taxation

This module is designed to prepare candidates for the requirements of reserved acts while consolidating their CPA advanced professional competencies.

Candidates who choose this path will have to complete the public accounting version of the Professional final exam, part 1.

CPA Leadership

In this module, candidates will take their knowledge to the next level. They’ll be required to call on all their technical and behavioural competencies to solve complex problems based on real-world situations.

Candidates will learn how to:

- Make informed decisions

- Exercise professional judgment

- Adopt a responsible leadership attitude

- Employ critical thinking in challenging ethical situations

This module marks another turning point, as candidates will develop a comprehensive view of the issues surrounding business decisions.

CPA Professional Readiness

Through realistic case studies, candidates will refine their skills, sharpen their professional ethics, and deepen their understanding of the CPA’s role in an ever-changing world.

In this module, candidates will explore:

- The Code of ethics of chartered professional accountants

- Effective collaboration

- Emerging issues, including sustainability, artificial intelligence, globalization, and governance

This five-day intensive module and its associated exam are the final steps to obtaining the CPA designation. Candidates must complete their practical experience before starting it.

Keep in mind that this module is only offered by the Order (combination of online and in-person learning).

Obtaining the CPA auditor designation

Program

Candidates wishing to obtain a public accountancy permit must choose the CPA Core – Common + Public accountancy module.

Exam

Candidates wishing to obtain a public accountancy permit must pass the public accounting version of the Professional Final Exam, part 1.

Practical experience

To obtain a public accountancy permit, you must:

- Complete 24 months of practical experience at an audit firm1 where you can work toward and achieve learning objectives in financial reporting, auditing, and assurance.

- Complete 24 months of practical experience including 1,250 hours providing assurance on historical financial information, of which 625 hours must be spent auditing general-purpose financial statements for different types of clients in various industries (these 625 hours are not required to obtain the CPA auditor limited to review engagements designation).

- Be under the guidance of a CPA mentor who holds a public accountancy permit.

1 The firm and all members working there must not have been subject to any qualified opinion regarding the hiring of future CPAs from the Order’s professional inspection committee.

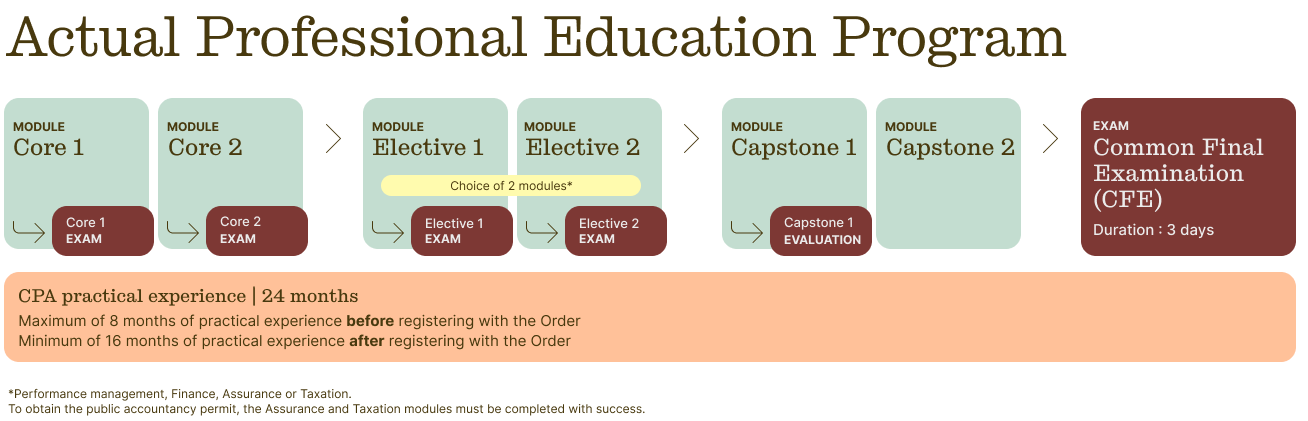

New program versus current program

Here are the differences between the two programs

Transition to the new program

Are you currently registered for the CPA Professional Education Program (National Program or graduate-level university program)?Are you currently in a bachelor’s degree program or in the training equivalence process and planning to start the CPA Professional Education Program before 2027? |

|

FREQUENTLY ASKED QUESTIONS

This FAQ is designed to answer your questions about specific situations and provide more details on certain points.

It will be updated on an ongoing basis as new questions are received. Stay tuned for updates.

General questions

1. You say that there is already a program underway and that the new program will launch in January 2027. Which program should I register in if I want to become a CPA?

If you register before January 2027 to begin the process of obtaining the CPA designation, you must register in the current CPA Professional Education Program, in either a graduate program or the National Program delivered by the Order. Depending on how long it takes you to complete the process, you may have to transition to the new program at a certain point, if the current program ceases to be offered at your university or by the Order. To learn more, consult our web page explaining different transition situations (in French only).

If you register in January 2027 or later, you can only register in the new program, either through a graduate program or through the program delivered by the Order.

2. Will the CPA designation obtained through the new professional program be different?

The new professional program will not change the CPA designation or its legal recognition. Candidates who complete the process through the new program will receive the same designation as current CPAs, with the same reserved acts and professional rights and obligations as CPAs who received the designation through the current program. The national and international mobility of CPA designation holders will also be maintained. The change in program mainly concerns the structure and the educational content, but the ultimate objective—becoming a CPA—remains exactly the same.

3. How long will the process to obtain the CPA designation, and the program itself, take under the new professional program?

The maximum time allowed to complete the entire process will be seven years, as is currently the case. However, the actual duration may vary depending on several factors, including the option chosen for the program (graduate program or program delivered by the Order).

The program itself should take between 9 and 24 months, as is currently the case, depending on the candidate’s choices.

Each module will take between 6 and 12 weeks, followed by 1 or 2 weeks of preparation for the accompanying module exam.

Please note that the program is still being developed, and that the exact duration is to be confirmed. The durations provided are therefore for reference purposes only and are subject to change.

4. I am currently a candidate for the practice of the CPA profession. Will I need to transition to the new program?

You will only need to transition to the new program if your current graduate program or your remaining National Program modules cease to be offered.

To learn more about transition situations and consult the table comparing the two programs, visit our transition web page (in French only).

If you do need to transition, the Order will provide you with personalized assistance. Transitioning candidates will have their prior modules and exams recognized as detailed in the table on the transition web page. Our teams will also conduct an analysis to make sure that your knowledge and competencies are up to date. If not, refreshers may be required.

5. Will the new professional program still have two options, i.e., university graduate program or the program delivered by the Order, similar to the National Program?

Yes, these two options will still exist in the new professional program. Registration for both options will begin in January 2027.

6. How will the new program affect the maximum seven-year period allowed to complete the process of obtaining a CPA designation?

Candidates whose seven-year periods end on December 31, 2028, or earlier must finish the process in the current program, unless the program for which they are registered ceases to be offered. Unless there are extraordinary circumstances preventing them from progressing through the process, these candidates will not be given any additional time.

If a candidate’s period allowed by the Order ends after December 31, 2028, and they have not completed the process by that date, they must transition to the new program. An additional three years will be granted to allow them time to complete the process, thereby extending the deadline imposed by the current program. The maximum time allotted will be seven years in total.

This way, regardless of the duration remaining at the time of transition, candidates will have at least three years and at most seven years to complete the process. The table below illustrates this rule.

| Duration remaining at the time of transition | New duration granted after the transition |

| 6 years | 7 years |

| 5 years | 7 years |

| 4 years | 7 years |

| 3 years | 6 years |

| 2 years | 5 years |

| 1 year | 4 years |

7. What learning resources will be provided to candidates in the new program?

Academic guides and practice exams will be made available to candidates to help them prepare for their exams and encourage them to submit work according to a common structure that allows for consistent and fair evaluation. In addition, learning through practical scenarios will remain core to the new program. All candidates will have access to these scenarios via the digital platform used for the program.

8. Will candidates in the program option delivered by the Order have access to Pratik under the new program? Will they have access to the same materials as those in the graduate option?

The materials used by universities via Pratik will remain accessible. However, an evaluation of universities’ needs regarding materials will be conducted to ascertain what should be kept or updated. The materials used by candidates in the program delivered by the Order will be accessible in the selected learning platform. All candidates will also continue to have access to accounting standards on the Knotia platform.

9. What learning materials will be available under the new program for the option delivered by the Order versus the graduate option?

The new program will offer updated materials that focus on emerging competencies and interactive digital tools. Universities that deliver the graduate option will keep their own resources and develop the materials needed for their programs.

10. How should candidates proceed when moving from the current graduate option to the option delivered by the Order or from the current National Program to the graduate option under the new program?

A personalized evaluation of the candidate’s file will need to be done by the Order or the university in question, as applicable. Equivalencies may be recognized, but certain learning activities may need to be repeated because the two options are quite distinct, even though they both follow the CPA Competency Map 2.0. Our teams will also conduct an analysis to make sure that the candidate’s knowledge and competencies are up to date. If not, refreshers may be required.

11. What will the new professional program look like in the graduate option?

The format should be largely the same as in the current program. Accredited universities will deliver the new program at the graduate level, although some may choose a diploma type other than the advanced graduate diploma (DESS). The number of credits remains to be determined. Universities will tailor the content of classes and evaluations to the principles of the new program. Note that the final module, CPA Professional Readiness, will only be offered by the Order.

While universities will administer the exam for the Foundational Development module to candidates in the graduate option, the Order will be responsible for the exams for the following modules: Foundational Development (for candidates in the program delivered by the Order), CPA Core (common and public accountancy streams), CPA Leadership, and CPA Professional Readiness. Regardless of the option they choose, all candidates must pass these three qualifying final exams.

12. What will the new program look like in the option delivered by the Order?

The new program will be similar to the current National Program, in that it will be made up of modules followed by exams. However, there will no longer be a Common Final Examination. Instead, evaluations will take place throughout the process. In addition to a Foundational Exam , there will be a Professional Final Exam taken in three parts, following the CPA Core module (common or public accountancy stream), the CPA Leadership module, and the CPA Professional Readiness module, respectively. The other main differences will be in the nature of the content and the teaching method.

13. Will the D2L platform be used in the same way?

We are currently evaluating digital platform options for the new program. We may or may not continue to use D2L.

14. Can candidates who are currently registered in one of the two options of the current Professional Education Program receive assistance from the Order?

Note that candidates in the current program will be required to continue in the current program until it is no longer offered at their university or until the Order ceases to offer their remaining modules and exams.

Our teams will provide assistance to all candidates to help them finish the process under the current program if possible. The Order is also working to explain the steps for people who need to transition to the new program as clearly as possible.

To provide guidance, communications have been sent to candidates. Additional communications will be sent during the period leading up to the end of the current program in December 2028.

Our teams will also conduct an analysis to make sure that the candidate’s knowledge and competencies are up to date. If not, refreshers may be required. Evaluations will take place on a case-by-case basis.

15. Will the minimum undergraduate grade point average of 2.8 still be required to be admitted to the new CPA Professional Program?

A minimum grade point average of 2.8 will no longer be required for the program delivered by the Order. This change is the result of a directive of the Commissioner for Admission to Professions, which prohibits having academic performance requirements to access professional training.

However, this rule does not apply to programs in the graduate option. Each university is at liberty to establish its own admission requirements as long as it meets the Order’s basic conditions. Certain universities may therefore continue to require a minimum average for candidates to be admitted to their CPA programs. These requirements are governed by the universities’ internal regulations, over which the Order has no control.

Please note that the other admission requirements currently in effect will remain, including successful completion of a bachelor’s degree recognized by the Order and having obtained this degree within the five years preceding the admission application.

Note also that admission requirements may differ in other Canadian provinces and territories.

16. It is possible that there will be a significant change to dues under the new program?

No changes to dues are anticipated at this time. The Order’s teams are working hard to offer candidates a program of the highest quality at a competitive price.

17. Will the new professional program be more expensive than the current program?

For the program delivered by the Order, the Order’s teams are working hard to offer candidates a program of the highest quality at a competitive price. However, the cost may be reassessed periodically, partially based on the investment needed to support the program’s modernization.

For the graduate option, each university is at liberty to set fees for its programs. These fees may therefore vary from one university to another.

18. How will accommodations work under the new program?

It will still be possible to receive accommodations, but the process will be determined at a later date.

19. Will it be possible to re-enrol or extend the deadline to complete the process under the new program?

Yes. Re-enrolment and extensions will be possible, subject to related administrative terms. As in the current program, it will be possible to request an extension of the deadline for completing the process or to re-enrol in the program in certain situations, such as parental leave, complementary studies, and similar situations.

20. What will happen if a candidate re-enrols after being in the current program once the new program starts?

Recognition mechanisms are planned to ensure that education and experience equivalencies can be established fairly. For example, a candidate who completed certain modules or a portion of their practical experience under the current program will be able to have some of this education or experience recognized, in accordance with the equivalency table for the new program (in French only), if it is deemed equivalent to the requirements of the new program.

Our teams will also conduct an analysis to make sure that the candidate’s knowledge and competencies are up to date. If not, refreshers may be required. Evaluations will take place on a case-by-case basis.

21. Will there be a special program for accounting master’s degree holders who wish to become CPAs?

The program will be the same for everyone. Prior studies will continue to be one criterion that is taken into account when analyzing files as part of the equivalency process for people who do not have a recognized bachelor’s degree.

22. How will the new program affect members?

The launch of the new program will not impact current CPA designation holders. However, CPAs will be able to benefit from a supplemented continuing education offering, or one that incorporates the new competencies in the program, such as sustainability and data governance.

Exams

1. How will exams work?

The exam for the Foundational Development module will be offered by universities for candidates in graduate programs and by the Order for candidates in the program delivered by the Order.

The three parts of the Professional Final Exam will be offered at the end of the CPA Core module, the CPA Leadership module, and the CPA Professional Readiness module, respectively. These three exams will replace the current module exams and the Common Final Examination (CFE). They will be offered to all candidates by the Order only. There will no longer be a consecutive three-day exam, as is currently the case with the CFE.

All exams in the new program will be offered in person only.

2. When will the three parts of the Professional Final Exam and the exam for the Foundational Development module (for the program delivered by the Order) take place?

There will be three exam sessions each year, in September, January, and May, except for 2027, when a single exam session will be held (planned for September 2027).

3. Where will the three parts of the Professional Final Exam and the exam for the Foundational Development module (for the program delivered by the Order) take place?

These exams will be taken at an exam centre located in Montréal in September, January, and May. For other regions, an analysis will be conducted to evaluate the potential volume of candidates for each of the three sessions. Decisions still need to be made about other exam centres. However, exams will be offered in centres outside Montréal at least once per year.

The exams will require the use of a computer.

4. Will the Order offer an exam prep service?

Yes. This service will be offered to help candidates prepare for the three parts of the Professional Final Exam. Details on this service will be communicated at a later date.

5. Can a candidate be expelled from the new program for failing one or more parts of the Professional Final Exam?

Candidates will be given three attempts to pass each part of the exam. After three failed attempts, they will be expelled from the process of becoming a CPA. Expelled candidates may then submit a re-enrolment application. They may have to complete certain training before resuming the process.

6. What will happen if a candidate in the current program fails the last-ever Common Final Examination (CFE) in September 2028? How many attempts are permitted under the new program?

Candidates who fail the last-ever CFE will be able to transition to the new professional program, provided that it is not their third and final attempt. Then, they will have a maximum of three attempts to pass each exam under the new program.

However, if the failure was their third attempt, they will be expelled from the program in accordance with the Order’s current policy. In such cases, expelled individuals may submit a re-enrolment application. They may have to complete certain training before resuming the process.

7. Is there a maximum time period for taking each part of the Professional Final Exam?

Candidates will have one year following the completion of each module to take the corresponding part of the Professional Final Exam. If they do not, this will count as a failed attempt. The time limit may be different for some universities.

Practical experience

1. What will practical experience look like under the new professional program?

There will still be 24 months of practical experience, as is currently the case, but the structure will be revised to emphasize the progression of competencies.

One major change in the new professional program is that practical experience will no longer have the same two categories (pre-approved program and experience verification). With the new program, all practical experience will follow a uniform process based on a standardized work plan. This plan must be drafted and signed by a CPA who has an active working relationship with the candidate. Then, it must be approved by the Order.

In addition, depending on the type of practical experience, as well as the structure and level of detail of the submitted work plan, only one end of practical experience report may be required, unlike in the current model, in which reports are required every six months in addition to the final report. This change aims to make the process less cumbersome while maintaining a high level of supervision and rigour.

The new practical experience model will include two types of experience:

- Foundational work experience (maximum of 8 months): During this phase, which is generally at the beginning of their practical experience, candidates develop foundational competencies. Note that any experience a candidate acquires before registering with the Order can only be recognized as foundational work experience.

- Professional work experience (minimum of 16 months): During this phase, candidates develop competencies at a more advanced level of judgment, autonomy, and complexity.

Note that the foundational stage is not mandatory or systematic. Candidates can begin their work experience directly in the professional stage, depending on the nature of their position and their workplace, as long as it meets the requirements of the professional phase. If so, this phase will last 24 months.

If a candidate has a properly structured work plan that demonstrates that they will acquire and apply competencies at an advanced level, this may justify beginning their practical experience directly in the professional phase.

2. What will happen to candidates who have already started their practical experience when registration for the new professional program begins on January 1, 2027?

Candidates will be required to continue their work experience under the current model until the end of the current program on December 31, 2028. If their practical experience is not finished on that date, it must continue under the new program model.

In general, practical experience authorized under the current program will continue to be authorized under the new program. In rare cases where an adjustment is necessary, the Order will communicate directly with the candidates in question.

3. If a candidate was deemed to have satisfied the requirements for practical experience but does not pass the Common Final Examination (CFE) before the deadline for the transition, will the practical experience still be recognized?

Yes. Practical experience and passing the CFE are two distinct requirements that are evaluated separately. If a candidate’s practical experience requirements were found to have been met, their experience will remain valid, even if the candidate must transition to the new program to complete the process.

4. What will happen to the practical experience report?

In general, there are two possible models, depending on the nature of the work plan, which is a new element that will replace the declaration of start of practical experience and the declaration of prior practical experience under the new professional program.

- If the work plan anticipates that competencies will be developed in such a way that meets the requirements in their entirety within 24 months, only one report may be required. It must be submitted at the end of the practical experience.

- If the work plan anticipates that the required competencies will be recognized progressively, reports must be submitted at key times to enable continuous evaluation of competency advancement.

5. How will the practical experience declaration process work? What forms or reports will candidates need to submit?

To reflect the requirements of the new program, all current forms will be replaced by two key documents: the work plan (which will replace the current declaration of start of practical experience and declaration of prior practical experience) and the end of practical experience report (which will replace the current declaration of the end of a practical experience period and practical experience reports).

Note that certain details about the declaration process, including the precise times for submitting the work plan and practical experience report, are still being established. A detailed process will be implemented to govern the recognition of practical experience before the transition takes place.

Training equivalencies

1. Will the time it takes to analyze equivalence files stay the same?

The time it takes may vary somewhat depending on the complexity of the file and the new evaluation schedules implemented with the new program. However, the Order expects that wait times will remain reasonable and comparable to current ones.

2. Will the prerequisites for equivalency recognition remain the same?

Key prerequisites (e.g., financial accounting, auditing, and taxation courses) will be largely the same. However, certain competencies may be organized or evaluated differently under the new framework. New evaluation schedules or a standard schedule will be developed in anticipation of the new program.

3. Will the training equivalency agreements that are currently in place be maintained in their current form?

At this time, national and international mobility agreements, such as mutual recognition agreements and interprovincial transfers, have been maintained. However, certain terms of application may be adapted to reflect the requirements of the new program. Discussions or adjustments may also become necessary as international partners become familiar with the new program.

Questions?

If you have any questions about the new CPA Professional Program, email our team at candidatCPA@cpaquebec.ca.

Stay tuned for our next communications.