Accounting for retractable or mandatorily redeemable shares: Same exception paragraph, different conditions

Published on

Updated: April 29, 2020 folllowing the one-year deferral, to January 1, 2021, of the effective date of the modifications that were supposed to apply for years beginning on or after January 1, 2020. Early adoption of the modifications continues to be permitted.

Significant changes published in December 2018

After reading our article Accounting for retractable or mandatorily redeemable shares and other financial instruments: Significant changes, published in February 2019, you will have understood that the amendments relate specifically to the exception in paragraph .23 of Section 3856, Financial Instruments, in accounting standards for private enterprises (ASPE), which allows the classification of certain retractable or mandatorily redeemable shares issued in a tax planning arrangement (ROMRS) as equity. The following is an overview of the changes.

Underlying premise that nothing of substance has changed

In their responses to the exposure drafts on ROMRS issued in 2014 and 2017, as well as during consultations on the subject held by the Accounting Standards Board (AcSB), several stakeholders argued that an exception to liability classification should be permitted because “nothing of substance has changed in the management and operations of the enterprise before and after a tax planning arrangement.”1 The concept that nothing of substance has changed was retained as the underlying premise in the amended exception in paragraph 3856.23.

The following is an example of when nothing of substance has changed:

The following are examples of when something of substance has changed:1. A shareholder who owns 70% of the voting shares executes an estate freeze by exchanging his shares for ROMRS that carry the same voting rights.

2. A shareholder who owns 30% of the voting shares executes an estate freeze by exchanging his shares for ROMRS. Before the estate freeze, this minority shareholder could neither unilaterally declare a dividend on his shares, nor require redemption of the shares. After the estate freeze, the shareholder has the ability to redeem his shares on demand.

3. In a tax rollover, the freezor transfers a building to an enterprise on a tax-deferred basis in exchange for ROMRS. The receipt of the building by the enterprise will change the enterprise’s future cash flows.

4. An enterprise issued ROMRS many years ago. The shares were owned by the controlling shareholder. Other shares were recently issued resulting in this shareholder no longer retaining control of the enterprise.

5. In the past, an enterprise issued ROMRS. The holder has recently asked the enterprise orally to redeem the shares over a five-year period. Since the shares are redeemable at the option of the holder, the enterprise must comply with the demand. The existence of a redemption schedule points to the holder as ultimately controlling the timing of the cash outflows relating to the shares.

The amended exception includes conditions to ensure compliance with this premise. Although some may disagree with these conditions, it is important to remember that it is difficult to formulate a perfect exception, and the amended exception is better than no exception at all.

Conditions for the exception

An enterprise that issues ROMRS in a tax planning arrangement may choose to classify these shares as equity when they meet all the conditions in amended paragraph 3856.23. Paragraph .23 now reads as follows:

“An enterprise that issues retractable or mandatorily redeemable shares in a tax planning arrangement may choose to present those shares at par, stated or assigned value as a separate line item in the equity section of the balance sheet only when all of the following conditions are met:

(a) control […] of the enterprise issuing the retractable or mandatorily redeemable shares […] is retained by the shareholder receiving the shares in the arrangement;

(b) in the arrangement, either:

(i) no consideration is received by the enterprise issuing the retractable or mandatorily redeemable shares; or

(ii) only shares of the enterprise issuing the retractable or mandatorily redeemable shares are exchanged; and

(c) no other written or oral arrangement exists, such as a redemption schedule, that gives the holder of the shares the contractual right to require the enterprise to redeem the shares on a fixed or determinable date or within a fixed or determinable period. […]” (amended 3856.23) (Emphasis added)

Control

Paragraph (a) requires that the shareholder receiving the ROMRS control the enterprise before and after the share issue. This assessment of control should be performed by applying the guidance for control in Section 1591, Subsidiaries. If an enterprise issues shares to a related party group, Section 3856 requires an assessment of which related party controls the enterprise to determine whether this condition is met. Only one party in any related group can have control. This assessment of control should be performed by analyzing all facts and circumstances. A related party has control over the enterprise when it has the continuing power to determine its strategic operating, investing and financing policies without the co-operation of others. Section 1591 was amended to add guidance on substantive rights.

In the second example above, the condition in paragraph (a) is not met, since the shareholder receiving the ROMRS is a minority shareholder. This shareholder does not have control of the enterprise before or after the issuance of the ROMRS. This example is based on Example 5 added at the end of Section 3856.

Consideration

Paragraph (b) requires that in the arrangement no consideration be received by the enterprise issuing the ROMRS (as with ROMRS dividends) or that the only consideration exchanged be in the form of shares (shares exchanged for ROMRS).

In the third example above, the condition in paragraph (b) is not met, since the enterprise issuing the ROMRS received (through a rollover) a building as consideration.

Some may think that this condition could be met through a series of arrangements. It should be noted that the standard specifies that a series of transactions made in contemplation of each other should be viewed as a single tax planning arrangement when determining if the conditions have been met. For example, an enterprise may first exchange common shares for ROMRS, followed by an exchange of a building for cash. If these steps are executed in contemplation of each other, the enterprise needs to assess the substance of the transaction holistically.

Redemption arrangement

Paragraph (c) of the amended exception requires that there be no other written or oral arrangement requiring redemption of the ROMRS within a fixed or determinable period. For example, this condition is not met if there is a redemption schedule specifying timing of redemption of the shares.

Option to present ROMRS as a financial liability

Since ROMRS meet the definition of a financial liability, an enterprise may choose to present them as a liability, without assessing the exception conditions that could allow equity classification. Some respondents to the 2017 Exposure Draft requested this possibility for flexibility and cost-savings reasons. Among other things, this option enables enterprises to classify and measure all ROMRS in the same manner as a liability, whether or not they meet the exception conditions. Clearly, the idea of presenting shares as a liability has come a long way.

ROMRS classified as a financial liability

Classification

When an enterprise issues ROMRS in a tax planning arrangement and all the conditions in amended paragraph 3856.23 are not met for some or all of the shares issued, the enterprise must classify those shares as a financial liability. An enterprise that issues ROMRS in a tax planning arrangement may also choose to present these shares as a financial liability.

Measurement

An enterprise is required to initially and subsequently measure ROMRS classified as a financial liability in accordance with amended paragraph 3856.23 at the redemption amount (discounting is not permitted). Any resulting adjustment (the amount charged) should be recognized in retained earnings or a separate component of equity. The option to recognize the adjustment in retained earnings comes at the request of respondents to the 2014 Exposure Draft who advised the AcSB that recording it as a separate component of equity could have an adverse effect on the small business deduction for Quebec enterprises.

Measuring ROMRS at the redemption amount could have future income tax implications for enterprises applying the future income taxes method.

Presentation and disclosure

ROMRS classified as a financial liability should be separately presented on the balance sheet. In addition to the disclosure required for financial liabilities, an enterprise should disclose a description of the arrangement that gave rise to the ROMRS as long as the shares exist.

When an enterprise has elected to recognize in retained earnings the adjustment resulting from measuring ROMRS classified as a financial liability at their redemption amount, it should disclose on the face of the balance sheet the amount charged to retained earnings for all classes of such shares. When an enterprise has instead elected to present this adjustment as a separate component of equity, it should disclose that the balance of this component will be charged to retained earnings as the shares issued are called for redemption.

Reclassification

ROMRS classified as a financial liability cannot subsequently be reclassified to equity (even if all conditions for equity classification are met.)

ROMRS classified as equity

Measurement

An enterprise is required to initially and subsequently measure ROMRS classified as equity in accordance with amended paragraph 3856.23, at their par, stated or assigned value.

Presentation and disclosure

ROMRS classified as equity should be presented as a separate line item in the equity section of the balance sheet. The enterprise should disclose on the face of the balance sheet, the total redemption amount for all classes of such shares outstanding. The enterprise should also disclose the following: the aggregate redemption amount for each class of such shares and a description of the arrangement that gave rise to the shares, as long as the shares exist.

Reclassification

ROMRS classified as equity are not subsequently reclassified unless an event or transaction occurs that may indicate the conditions for equity classification are no longer met. Section 3856 provides examples of such events or transactions, including the death of the holder of ROMRS and the redemption of some of the ROMRS. Reassessment of the equity classification would not automatically lead to reclassification of ROMRS as a financial liability. If the ROMRS are reclassified as a financial liability, the enterprise should measure the shares at their redemption amount on the date the event or transaction occurs. Any resulting adjustment should be recorded in retained earnings or a separate component of equity.

In the fourth example above, assuming that the conditions in amended paragraph 3856.23 were initially met and the ROMRS were classified as equity, the condition in paragraph (a) is no longer met, since the shareholder holding the ROMRS no longer controls the enterprise. Therefore, the ROMRS should be reclassified as a financial liability and remeasured at their redemption amount.

In the fifth example above, assuming that the conditions in amended paragraph 3856.23 were initially met and the ROMRS were classified as equity, the condition in paragraph (c) is no longer met, since there was a redemption arrangement. Therefore, the ROMRS should be reclassified as a financial liability and remeasured at their redemption amount.

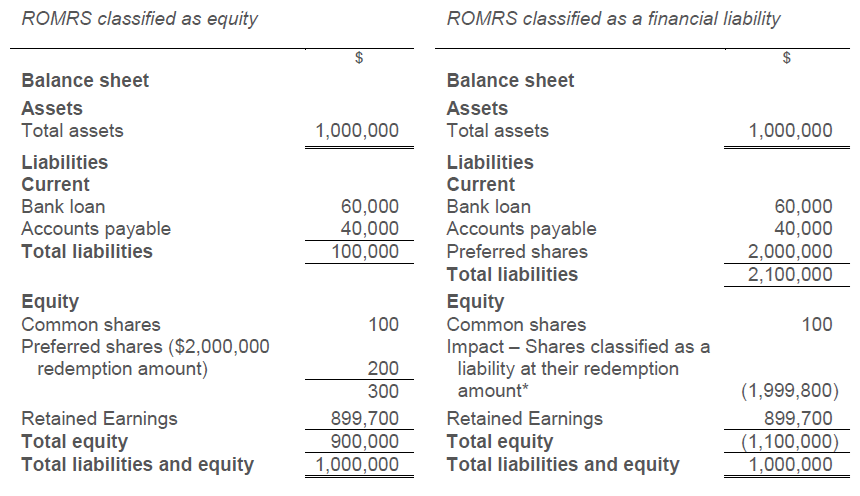

Example of effects on the balance sheet

The following excerpts from a balance sheet illustrate the potential impact of classifying ROMRS as equity or as a financial liability.

* When an enterprise has elected to recognize in retained earnings the adjustment resulting from measuring ROMRS classified as a financial liability at their redemption amount, it should disclose on the face of the balance sheet the amount charged to retained earnings for all classes of such shares.

take action today

Since fewer shares are expected to meet the exception criteria and the classification of shares as a liability at the redemption amount will result in significant changes to the balance sheet, you should think ahead now. You should promptly plan a discussion with your financial statement users to explain the changes, agree on adjustments (e.g. changing ratios provided for in contracts or the definition of these ratios) and remind them that, in substance, the enterprise’s resources are the same as they were the day before.

effective date and transition

These amendments apply to annual financial statements relating to fiscal years beginning on or after January 1, 2021, with earlier application permitted. The transitional provisions in Section 3856 include relief measures to lessen and, in some cases, prevent impacts on transition.

To find out more read our article "Transition – Retractable or mandatorily redeemable shares and financial instruments originated or exchanged in a related party transaction".

be vigilant

This article provides an overview of some requirements and does not address all topics, all their aspects or the particular circumstances facing any one enterprise. Be vigilant and refer to the updated original documents before making a decision.

additional resources

- Article: Accounting for retractable or mandatorily redeemable shares and other financial instruments: Significant changes, published on February 4, 2019.

- AcSB webinar: Amendments to Section 3856, Financial Instruments (December 2018).

- AcSB supporting document: Basis for Conclusions – Retractable or Mandatorily Redeemable Shares Issued in a Tax Planning Arrangement (December 2018).

ORDRE DES COMPTABLES PROFESSIONNELS AGRÉÉS DU QUÉBEC

NOTE

- Source: Basis for Conclusions – Retractable or Mandatorily Redeemable Shares Issued in a Tax Planning Arrangement (December 2018).