Amendments to Section 3462, “Employee Future Benefits” – Funding valuation and inclusion of stabilization provision

Published on

Context

In November 2020, the Canadian Accounting Standards Board (AcSB) issued amendments to Section 3462,1 “Employee Future Benefits,” in Part II of the CPA Canada Handbook – Accounting. To highlight the key changes resulting from these amendments and to discuss some of the potential assurance implications, CPA Canada issued a briefing in February 2021 titled Financial Reporting Alert – Accounting Standards for Private Enterprises (ASPE) – Amendments to Section 3462, “Employee Future Benefits”. One of these changes is the new requirement to include all components that determine the contributions to be made to the plan in the calculation of the defined benefit obligation, which results in the inclusion of the stabilization provision for Quebec registered pension plans.

The Quebec CPA Order (hereinafter “the Order”) pension plan working group met to discuss the practical application of including the stabilization provision in the defined benefit obligation. This document presents the consensus reached by the members of the working group for calculating the stabilization provision (SP) to be included in the defined benefit obligation (DBO) for plans registered in Quebec.

Applicability

It should be noted that the amendments only apply to enterprises or organizations using an actuarial valuation for funding purposes to measure the DBO of pension plans they offer their employees.

Enterprises and organizations using an actuarial valuation prepared for accounting purposes to measure their DBO are not affected by these amendments.

One of the amendments to Section 3462 clarifies that funding valuations are prepared in accordance with legislative, regulatory or contractual requirements that determine the required contributions to the plan2.

The amendments apply to annual financial statements for fiscal years beginning on or after January 1, 2022.

Regulations in force in Quebec

In Quebec, pension regulations (the SPP Act)3 require that private sector defined benefit pension plans fund a SP. This SP is expressed as a % of the actuarial liability (on a funding basis) and is specific to each plan. The SP conceptually represents a reserve for poor plan experience. This reserve must be funded by contributions to the plan and therefore represents outflows that the plan sponsor and, where applicable, the active members are obligated to make.

For plans registered in Quebec, the SP is added to the current service contribution and the actuarial liability (i.e. the accrued obligation for past service) as follows:

- the SP minus 5% for past service (as per sections 38.1 and 132 of the SPP Act). For example, if the SP is set at 12%, the stabilization amortization payment is 7%, i.e. 12% minus 5%;

- the SP for current service (as per sections 38 and 128 of the SPP Act). For example, if the SP is set at 12%, the current service stabilization contribution to be paid is calculated based on the full SP of 12%.

Question

The Order’s pension plan working group therefore considered whether, in calculating the DBO, to include the full SP or, for past service, to include only the SP minus 5%, thereby including only what is a statutory funding requirement.

Consensus reached

The AcSB confirmed that “the amendments clarify that when legislative, regulatory or contractual requirements stipulate calculations of various components of the funding requirement separately, the aggregate of those components makes up the funding valuation that would be reflected in the financial statements. Accordingly, the measurement of the DBO in the financial statements reflects the aggregate of the components of the funding valuation.”4

Thus, the working group concluded that for current service, the full SP should be included in the calculation of the actuarial obligation, while for past service, only the SP minus 5% should be considered.

The group noted that this method will create an actuarial gain each fiscal year, even if no new actuarial valuation is prepared. This actuarial gain is created because the calculation of the DBO at year-end includes only the SP minus 5%, i.e. only the current service cost with the SP minus 5%, whereas the current service cost recognized as an expense during the year includes the full SP.

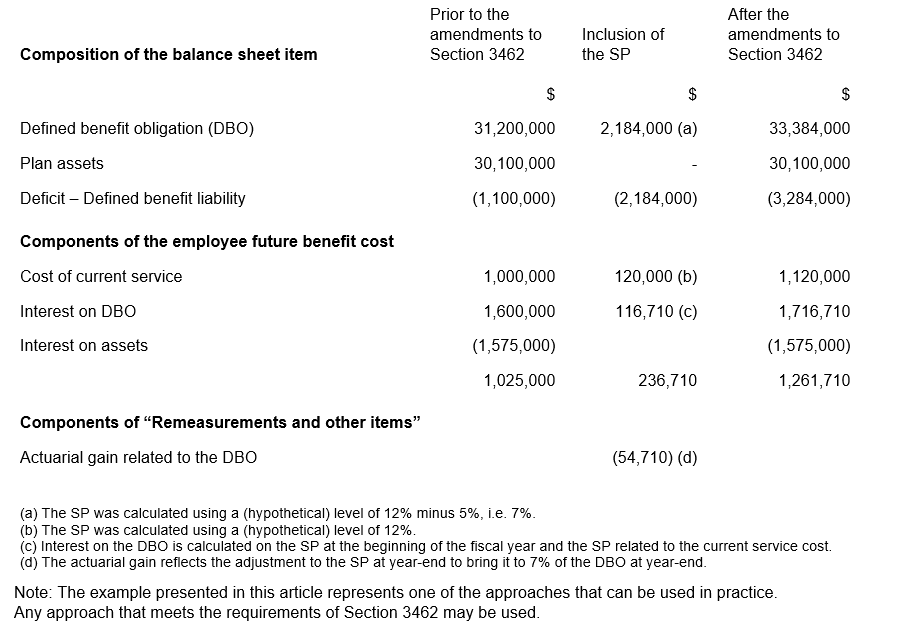

The following example illustrates the impact of the amendments to Section 3462 in relation to the inclusion of the SP in the calculation of the DBO for a funded pension plan registered in Quebec:

In addition, the members felt that it is not advisable to apply this consensus by analogy to other plans that are not registered in Quebec, including individual pension plans that are not registered with Retraite Québec, as pension regulations are not necessarily the same.

The professional practice team and selected members of the Quebec CPA Order pension plan working group (November 2021)

- The amendments to Section 3462 also apply to entities that apply Section 3463, “Reporting Employee Future Benefits by Not-for-Profit Organizations,” in Part III of the CPA Canada Handbook – Accounting.

- 3462.029AC

- R-15.1 – Supplemental Pension Plans Act

- Employee Future Benefits, Section 3462 – Background Information and Basis for Conclusions, paragraph 23 (November 2020)