Accounting for related party financial instruments: Major changes... To details!

Published on

Printable version [PDF]

Updated: April 29, 2020 folllowing the one year deferral, to January 1, 2021, of the effective date of the modifications that were supposed to apply for years beginning on or after January 1, 2020. Early adoption of the modifications continues to be permitted.

Significant changes issued in December 2018

After reading our article Accounting for retractable or mandatorily redeemable shares and other financial instruments: Significant changes published in December 2018, published in February 2019, you are aware of amendments relating to the accounting for related party financial instruments by private enterprises and not-for-profit organizations (NFPOs). Some 20 paragraphs on the topic were added to accounting standards for private enterprises (ASPE) Section 3856, Financial Instruments, and another 20 or so were added to its Appendix A, along with four examples. Around 30 paragraphs were also amended. It’s a lot to take in!

Reasons for the changes and implications

These changes were issued to address a number of concerns, including the fact that it was challenging to determine whether Section 3856 or Section 3840, Related Party Transactions, applied to the various elements of a related party transaction. It was also argued that Section 3840 was difficult to apply for the initial measurement of financial instruments in a related party transaction. As the objective was to clarify — not change — the accounting for related party financial instruments, minimal impact is expected on recognized amounts. However, it is important to note the following:

- you must review any amounts already recognized and financial statement disclosures, to ensure they meet the requirements;

- you must update the documentation on your analysis supporting these amounts, because most references to the applicable sections and paragraphs need to be changed.

Scope

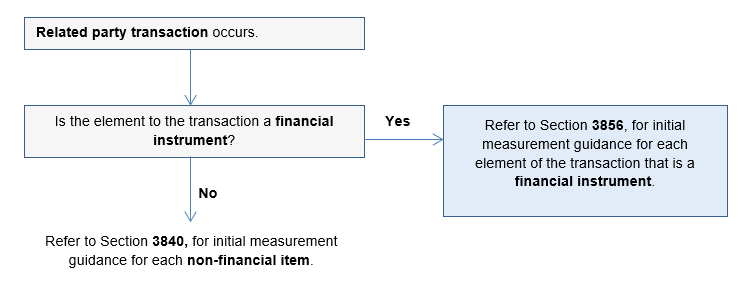

The measurement, recognition and derecognition of a financial asset originated or acquired or a financial liability issued or assumed in a related party transaction are now excluded from Section 3840 and addressed in Section 3856. Moreover, when a related party transaction includes a financial instrument, any difference arising from the recognition of items exchanged in the transaction must be accounted for in accordance with the requirements in Section 3856. The Decision Tree in Section 3840 has been amended to illustrate which section applies to initial recognition of the financial and non-financial items in a related party transaction. Here’s an excerpt:

Example 1 – Land in exchange for a loan1

Company X transfers land (an item of property, plant and equipment) to Company Y, owned by the same shareholder, in exchange for a $500,000 loan without interest or terms of repayment. The transaction is not in the normal course of operations.

The guidance related to the initial measurement and subsequent recognition of the related party loan (a financial instrument) and any difference resulting from the recognition of the items exchanged in the transaction is found in Section 3856.

The guidance related to the initial measurement of the land transferred between related parties (a non-financial item) is found in Section 3840.

Example 2 – Property, plant and equipment in exchange for cash and shares1

The same shareholder owns 90% of companies X and Y. Company X sells an item of property, plant and equipment to Company Y in exchange for $700,000 in cash and $200,000 in newly issued common shares (non-redeemable). The investment in common shares in Company Y is considered a portfolio investment (no significant influence). The transaction is not in the normal course of operations.

The guidance related to the initial measurement and subsequent recognition of the cash and of the investment in shares of a related party (financial instruments) and any difference resulting from the recognition of the items exchanged in the transaction is found in Section 3856.

The guidance related to the initial measurement of the item of property, plant and equipment sold between related parties (a non-financial item) is found in Section 3840.

1 Based on an exercise from the course OPÉRATIONS ENTRE APPARENTÉS – ASPECTS COMPTABLES SELON LES NCECF ET INCIDENCES FISCALES (in French only), without taking taxes into account.

Initial measurement of related party financial instruments

In general, when a financial asset is originated or acquired or a financial liability is issued or assumed in a related party transaction, the enterprise must initially measure it at cost. The cost will depend on whether the instrument has repayment terms. The following table summarizes the initial measurement:

| An enterprise must initially measure a related party financial instrument (FI) at cost (except as specified below this table): |

||||

| When the FI has repayment terms, its cost is equal to its undiscounted cash flow(s) (excluding interest and dividend payments, and less any impairment losses previously recognized). | When the FI does not have repayment terms, its cost is equal to the consideration transferred or received in the transaction: | |||

| When the consideration is a FI with repayment terms, the cost is equal to its undiscounted cash flow(s) (excluding interest and dividend payments, and less any impairment losses previously recognized). |

When the consideration does not have repayment terms, the cost is equal to its exchange amount when: (a) the transaction is in the normal course of operations; |

Otherwise, when the consideration does not have repayment terms, the cost is equal to its carrying amount. |

||

| When a related party transaction includes the exchange of multiple assets and liabilities, the value of the FIs without repayment terms is determined using the residual of the total consideration transferred in the transaction less the amounts attributed to the other assets or liabilities recognized in the transaction. | ||||

Basing the cost of a related party financial instrument on whether or not the instrument has repayment terms is an entirely new concept in Section 3856. The table presents a long process that generally leads to the same amount that we would have previously recognized. But remember, the objective was to clarify the requirements, not change them.

It’s important to remember that when a loan’s repayment terms are not specified, the loan is deemed to be payable on demand. Thus, even if a loan is described as being “without interest or terms of repayment,” in applying Section 3856, it does in fact have repayment terms, i.e. it is payable on demand.

Exceptions

Financial instruments at fair value

An enterprise must initially measure at fair value, without any adjustments, the following financial instruments originated or acquired or issued or assumed in a related party transaction:

- investments in equity instruments that are quoted in an active market;

- derivative contracts;

- debt instruments that are quoted in an active market;

- debt instruments when the inputs significant to the determination of fair value are observable, either directly or indirectly.

In practice, this situation will be rare.

Variable or contingent portion of a financial instrument

An enterprise must not initially measure the variable or contingent portion of a related party financial instrument. Instead, it has to remeasure the instrument at fair value when the contingency is resolved, with any gain or loss recognized in net income.

However, the issuer of a related party financial liability that is indexed to a measure of the enterprise’s financial performance or to changes in the value of the enterprise’s equity must adjust the carrying amount of the liability at each reporting date, to the higher of the cost of the debt and the amount that would be due at the balance sheet date if the formula determining the additional amount was applied at that date. The amount of the adjustment must be recognized in net income.

Retractable or mandatorily redeemable shares

Section 3856 sets out specific requirements for retractable or mandatorily redeemable shares issued in a tax planning arrangement. To learn more, read our article Accounting for retractable or mandatorily redeemable shares: Same exception paragraph, different conditions.

Liability and equity elements of related party financial instruments

Details on the initial measurement of the liability and equity elements of a compound financial instrument issued in a related party transaction are provided in the Appendix.

Gains, losses or differences arising in a related party transaction

As mentioned above, when a related party transaction includes a financial instrument, Section 3856, not Section 3840, applies to account for the difference between the exchanged items.

When the transaction is in the normal course of operations, or is not in the normal course of operations and the following criteria are met:

(i) the transaction is a monetary transaction or a non-monetary transaction that has commercial substance;

ii) the change in the ownership interests in the items transferred is substantive; and

iii) lthe transaction amounts for each of the elements in the transaction are supported by independent evidence,

any gain or loss resulting from initial recognition must be included in net income, unless another Section requires alternative treatment. Otherwise, any difference resulting from the transaction must be included in equity.

The general principle of recognizing the difference in net income when the transaction is in the normal course of operations, and in equity when it is not, is not new and is often required under sections 3856 and 3840. It is important to keep this in mind.

Example 1 (cont.) – Land in exchange for a loan

Information about the land immediately before the transfer:

- Carrying amount: $485,000

- Fair value: $505,000

No adjustment is needed for impairment of the land’s carrying amount. There is no balance in contributed surplus in the financial statements relating to previously recognized related party transactions.

Assuming that the related party financial instrument (the loan) is not quoted and that the inputs significant to the determination of its fair value are not observable, the financial instrument is initially measured at cost. Because the loan has repayment terms (no stated repayment terms, therefore deemed payable on demand), its cost is equal to the undiscounted cash flow(s), excluding interest.

| Entry – Company X (seller) | Entry – Company Y (buyer) | ||||

| Loan | $500,000 | Land2 | $485,000 | ||

| Land | $485,000 | Retained earnings | $15,000 | ||

| Contributed surplus | $15,000 | Loan | $500,000 | ||

Example 2 (cont.) – Property, plant and equipment in exchange for cash and shares

Information about the item of property, plant and equipment immediately before the sale:

- Initial acquisition cost: $750,000

- Net carrying amount: $600,000

No adjustment is needed for amortization or impairment of the item sold. There is no balance in contributed surplus in the financial statements relating to previously recognized related party transactions.

The related party transaction includes the exchange of multiple assets and liabilities.

Given that the shares constituting the related party financial instruments (the investment in shares) are not redeemable or quoted, the investment is initially measured at cost. Because the investment does not have any repayment terms, the transaction (the sale of an item of property, plant and equipment) is not in the normal course of operations, and the change in the ownership interests in the financial item transferred (the investment) is not substantive, the cost of the related party financial instrument (the investment) is equal to the carrying amount of the transferred consideration (the item of property, plant and equipment), less the amounts attributed to the other assets recognized in the transaction (the cash), since multiple assets are exchanged. A nominal value was assigned to the investment.

| Entry – Company X (seller) | Entry – Company Y (buyer) | ||||

| Cash | $700,000 | Property, plant and equipment2 | $600,000 | ||

| Investment in Company Y | $1 | Retained earnings | $100,001 | ||

| Accumulated amortization | $150,000 | Cash | $700,000 | ||

| Property, plant and equipment | $750,000 | Share capital | $1 | ||

| Contributed surplus | $100,001 | ||||

2 Initial measurement of the non-financial item, in accordance with Section 3840 on related party transactions.

Subsequent measurement of related party financial instruments

In general, an enterprise must subsequently measure a related party financial instrument based on how it initially measured the instrument:

- Financial instruments initially measured at cost

Subsequently measured using the cost method (adjusted for any impairment losses, reversals of impairment losses or forgiveness).

- Financial instruments initially measured at fair value

Subsequently measured as follows:

- Investments in equity instruments that are quoted in an active market and derivative contracts3: at fair value without any adjustment for transaction costs the enterprise may incur on sale or other disposal.

- Debt instruments quoted in an active market and debt instruments for which the inputs significant to the determination of their fair value are observable, either directly or indirectly4: at fair value, if the enterprise elects that fair value measurement shall apply and the instruments were so designated on initial recognition.

- Other financial assets: at amortized cost.

- Financial liabilities: at amortized cost.

However, for details on the subsequent measurement of a related party financial liability indexed to a measure of the issuer’s financial performance or to changes in the value of its equity and of retractable or mandatorily redeemable shares issued in a tax planning arrangement, see the Exceptions section above.

3 Derivative contracts that are not (i) designated in a qualifying hedging relationship, (ii) linked to, and must be settled by delivery of, equity instruments of another enterprise whose fair value cannot be readily determined.

4 Section 3856 provides clarifications on when an instrument ceases to be quoted in an active market or when inputs significant to the determination of its fair value are no longer observable.

Example 1 (cont.) – Land in exchange for a loan

Since the companies initially measured the loan at cost, they must subsequently measure it using the cost method.

Assuming that the loan has not yet been received and has not been changed, and that no impairment is necessary, no entry is required.

Example 2 (cont.) – Property, plant and equipment in exchange for cash and shares

Since Company X initially measured the investment in shares of Company Y at cost, it must subsequently measure it using the cost method.

Assuming that the investment has not been sold, that there have not been any dividends and that no impairment is necessary, no entry is required (except for amortization of the item of property, plant and equipment).

Impairment of related party financial assets

The general requirements relating to the impairment of related party financial assets (and reversals) are the same as those involving third parties. Any write-down is therefore always recognized in net income. However, the amount at which the financial asset measured at cost is reduced is slightly different in the following cases:

- Debt instruments originated or acquired in a related party transaction: reduce the carrying amount of the asset* to the highest of the following: (a) the undiscounted cash flows expected to be generated by holding the asset*, excluding the interest and dividend payments of the instrument; (b) the amount that could be realized by selling the asset* at the balance sheet date; and (c) the amount the enterprise expects to realize by exercising its right to any collateral held to secure repayment of the asset*, net of all costs necessary to exercise those rights.

- Equity instruments originated or acquired in a related party transaction: reduce the carrying amount of the asset* to the amount that could be realized by selling the asset* at the balance sheet date.

*Or group of similar assets

These requirements apply to the party holding the financial asset. The requirements relating to derecognition of a financial liability are discussed later. Asset impairment alone does not result in derecognition of the liability for the other party.

Example 1 (cont.) – Land in exchange for a loan

A few years later, Company X notes that Company Y is having financial difficulties. It now believes that it will only be able to receive half the loan. The loan cannot be sold and has no collateral.

| Entry – Company X (seller) | Entry – Company Y (buyer) | ||

| Impairment (net income) | $250,000 | Not applicable | |

| Loan | $250,000 | ||

Forgiveness of related party financial assets

A related party financial asset is forgiven when the enterprise terminates a liability for payment to settle the financial asset. Cancellation and release are examples of means of termination. After assessing for and recognizing any impairment, forgiveness of all or part of the financial asset is recognized in:

- equity, when the transaction that resulted in the origination or acquisition of the financial asset was not in the normal course of operations; or

- net income, when the transaction that resulted in the origination or acquisition of the financial asset was in the normal course of operations or when it is impracticable to determine whether the financial asset was originated or acquired in the normal course of operations or not.

In practice, the balance of a related party financial asset is often the cumulative result of several transactions, making it impracticable to identify the original transaction. To prevent forgiveness related to transactions in the normal course of operations from ending up in equity, forgiveness must be recognized in net income when it is impracticable to determine the asset’s origin.

NFPOs, however, must always recognize the forgiveness of a related party financial asset in the statement of operations. They already seem to be doing this.

These requirements apply to the party holding the financial asset; the requirements relating to derecognition of a financial liability are discussed in the following section.

Example 1 (cont.) – Land in exchange for a loan

Ten months after Company X recognized an impairment, Company Y made a settlement proposal to its creditors, such that Company X had to relieve Company Y from its obligation to repay the loan. Up until this moment, Company X still believed that it would be able to receive $250,000.

| Entry – Company X (seller) | Entry – Company Y (buyer) | ||

| Contributed surplus | $15,000 | Not applicable | |

| Retained earnings | $235,000 | ||

| Loan | $250,000 | ||

Derecognition of related party financial liabilities

Extinguishment of related party financial liabilities

In a transaction between related parties, the difference between the carrying amount of a financial liability (or part of a financial liability) extinguished or transferred to another related party and the amount of the consideration paid, including any non-cash assets transferred, liabilities assumed or equity instruments issued, must be recognized in:

- equity, when the original transaction that resulted in the issuance or assumption of the financial liability was not in the normal course of operations; or

- net income, when the original transaction that resulted in the issuance or assumption of the financial liability was in the normal course of operations or when it is impracticable to determine whether the amount extinguished was issued or assumed in the normal course of operations or not.

NFPOs, however, must account for the extinguishment of financial liabilities exchanged in a related party non-reciprocal transaction (without consideration) in accordance with Section 4410, Contributions — Revenue Recognition, in Part III of the CPA Canada Handbook – Accounting.

An enterprise initially measures equity instruments issued to a creditor to extinguish all or part of a financial liability issued in a related party transaction at the carrying amount of the liability extinguished.

Example 1 (cont.) – Land in exchange for a loan

When Company Y has been relieved from its obligation to repay the loan to Company X:

| Entry - Company X (seller) | Entry - Company Y (buyer) | ||

| Not applicable | Loan | $500,000 | |

| Contributed surplus | $500,000 | ||

Replacement or modification of related party financial liabilities

A transaction between related parties to replace all or a part of a debt instrument with another instrument or to modify the terms of an existing financial liability is accounted for as an extinguishment of the original financial liability and the recognition of a new financial instrument.

Related party financial liabilities that are convertible into equity instruments

See the Appendix for details on the derecognition of a convertible debt instrument issued in a related party transaction.

Disclosure

The new disclosure requirements that apply to related party financial instruments are as follows:

- If an enterprise recognizes the forgiveness of a related party financial asset in net income because it is impracticable to determine whether it was originated or acquired in the normal course of operations or not, the enterprise must disclose that fact and the nature of the transaction that gave rise to the financial asset.

- If an enterprise recognizes the extinguishment of a financial liability in a related party transaction in net income because it is impracticable to determine whether it was issued or assumed in the normal course of operations or not, the enterprise must disclose that fact and the nature of the transaction that gave rise to the financial liability.

- An enterprise that issues a related party financial liability or equity instrument with variable or contingent payments must disclose information that enables users of the financial statements to understand the nature, terms and effects of the variable or contingent payments, the conditions under which a payment will be made and the expected timing of any payment.

Effective date and transition

The amendments are effective for annual financial statements relating to fiscal years beginning on or after January 1, 2021. Earlier application is permitted. The transitional provisions in Section 3856 include relief measures to facilitate the transition.

Be alert!

This article provides an overview of some requirements and does not address all topics, all their aspects or the particular circumstances facing any one enterprise. Be vigilant and refer to the updated original documents before making a decision.

Additional resources

- Article: Accounting for retractable or mandatorily redeemable shares and other financial instruments: Significant changes published in December 2018

- Accounting Standards Board webinar: Amendments to Section 3856, Financial instruments (December 2018)

- Basis for Conclusions − Accounting for Related Party Financial Instruments and Significant Risk Disclosures (December 2018)

The Professional Practice, Assurance and Financial Accounting team

ORDRE DES COMPTABLES PROFESSIONNELS AGRÉÉS DU QUÉBEC

APPENDIX – COMPOUND RELATED PARTY FINANCIAL INSTRUMENTS

This Appendix discusses some of the unique aspects of the recognition of a financial instrument issued in a related party transaction that contains both a liability and an equity element.

Initial measurement of liability and equity elements

The issuer of a financial instrument issued in a related party transaction that contains both a liability and an equity element must classify the instrument’s component parts separately. Acceptable methods for initial measurement of these components include the following:

- The equity component is measured as zero. The entire proceeds of the issue are allocated to the liability component.

- The liability component is measured using the undiscounted cash flow(s), excluding interest and dividend payments, and deducted from the entire proceeds of the issue. The difference is allocated to the equity component.

The second method differs from the one permitted when the instrument is issued in an arm’s length transaction (as opposed to a related party transaction). In this case, the issuer can choose to measure the component that is easiest to measure and allocate the difference to the remaining component.

The sum of the amounts assigned to the liability and equity components on initial recognition is always equal to the amount that would be ascribed to the instrument as a whole. No gain or loss arises from recognizing the components separately.

Derecognition of liability and equity elements

On extinguishment of a convertible debt instrument issued in a related party transaction, the issuer allocates the consideration paid to the liability and equity elements as follows:

a) the consideration is allocated first to the liability, up to the carrying amount of the debt, including accrued interest, and the excess, if any, is accounted for in accordance with the general extinguishment requirements mentioned previously;

b) if the consideration paid to extinguish the instrument is less than the carrying amount of the liability, any shortfall is accounted for in accordance with the general extinguishment requirements mentioned previously.

In a transaction between related parties, when an option to convert a financial liability to equity is exercised and the issuer settles the obligation in cash, the enterprise accounts for the settlement as the extinguishment of the instrument. Any difference on extinguishment of the liability element is measured and recognized in accordance with the general extinguishment requirements mentioned previously. The settlement of the equity element is recognized as a capital transaction, with any gain credited to contributed surplus and any loss applied first against contributed surplus to the extent of prior gains, and then against retained earnings.

When the issuer of an instrument that was issued in a related party transaction offers a more favourable conversion ratio than the original ratio specified in the debt agreement, or offers additional shares if the holder converts the debt security by a specified time (i.e. in an induced early conversion), the number of shares converted under the terms of the original instrument is measured at the original contract price (i.e. based on the original conversion ratio), and any additional shares issued to induce the conversion are measured at fair value. Any resulting gain or loss is treated as follows:

a) the difference relating to the liability element is recognized in accordance with the general extinguishment requirements mentioned previously;

b) the difference between the carrying amount and the amount considered to be settled relating to the holder option element is treated as a capital transaction.