CPAs and financial statements

What are the differences between compilation, review and audit engagements? What role does the CPA play? Here’s what you need to know to navigate the engagement landscape.

Most entities, whether corporations, NFPOs or government agencies, are legally required to present annual financial statements to their shareholders, members or the government, as the case may be. The law also requires certain entities to have their financial statements audited. In most cases, an entity’s management, with oversight from those charged with governance, is responsible for preparing financial statements. The scope of the CPA’s mandate depends on the entity’s needs and the requirements it must satisfy.

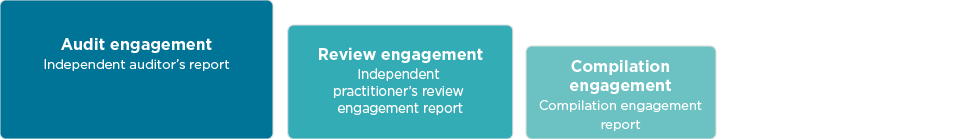

Chartered professional accountants provide three levels of service with respect to communications (reporting) on financial statements—an audit, a review or a compilation. CPAs perform these services in accordance with their code of ethics and assurance standards established by the Canadian Auditing and Assurance Standards Board (AASB). Assurance standards (which include audit, review and compilation standards) are contained in the CPA Canada Handbook – Assurance.

The nature and extent of the work performed by CPAs has a direct impact on the level of assurance or credibility given to the financial statements and the cost of audit, review and compilation services. For each service, the CPA provides a different communication (i.e. “Independent auditor’s report,” “Independent practitioner's review engagement report,” or “Compilation engagement report”), which sets out the extent of work performed and the level of assurance expressed by the CPA.

Three levels of service

| Communication provided with respect to the financial statements1 |

|---|

|

Independent auditor’s report [Appropriate Addressee] Opinion We have audited the financial statements of (COMPANY NAME) (the “Entity”), which comprise the balance sheet as at (DATE), and the statements of income, retained earnings and cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Entity as at (DATE), and the results of its operations and its cash flows for the year then ended in accordance with (APPLICABLE FINANCIAL REPORTING FRAMEWORK. Basis for Opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Entity in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Responsibilities of Management and Those Charged with Governance for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with (APPLICABLE FINANCIAL REPORTING FRAMEWORK), and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is responsible for assessing the Entity’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Entity or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Entity’s financial reporting process. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. Appropriate signature of auditor Date of the auditor's report Auditor's address |

| Communication provided with respect to the financial statements1 |

|---|

|

Independent practitioner's review engagement report [Appropriate addressee] We have reviewed the accompanying financial statements of (COMPANY NAME) that comprise the balance sheet as at (DATE), and the statements of income, retained earnings and cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with (APPLICABLE FINANCIAL REPORTING FRAMEWORK), and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Practitioner's Responsibility Our responsibility is to express a conclusion on the accompanying financial statements based on our review. We conducted our review in accordance with Canadian generally accepted standards for review engagements, which require us to comply with relevant ethical requirements. A review of financial statements in accordance with Canadian generally accepted standards for review engagements is a limited assurance engagement. The practitioner performs procedures, primarily consisting of making inquiries of management and others within the entity, as appropriate, and applying analytical procedures, and evaluates the evidence obtained. The procedures performed in a review are substantially less in extent than, and vary in nature from, those performed in an audit conducted in accordance with Canadian generally accepted auditing standards. Accordingly, we do not express an audit opinion on these financial statements. Conclusion Based on our review, nothing has come to our attention that causes us to believe that the financial statements do not present fairly, in all material respects, the financial position of (COMPANY NAME) as at (DATE), and the results of its operations and its cash flows for the year then ended in accordance with (APPLICABLE FINANCIAL REPORTING FRAMEWORK). Appropriate signature of practitioner Date of the practitioner's report Practitioner's address |

| Communication provided with respect to the financial statements1 |

|---|

|

Note: The compilation Engagement report replaces the Notice to reader for compiled financial information for fiscal periods ending on or after December 14, 2021. (with early application permitted). Compilation Engagement Report On the basis of information provided by management (or the proprietor), I have compiled the balance sheet of (COMPANY NAME) as at (DATE), the statements of income and retained earnings for the year then ended, and Note X, which describes the basis of accounting applied in the preparation of the compiled financial information [and, if applicable, other explanatory information] ("financial information"). Appropriate signature of practitioner Date of the practitioner's report Practitioner's address |

1. Note that this report may vary depending on the circumstances.